In the summer of 2016, I and my students were in the industrial city of Shenzhen, South East China, conducting a small exploratory study aimed at gaining an overview of migrant factory workers’ attitudes towards digital money platforms. Over two weeks, we had spoken to many migrant factory workers, uncovering a range of differing attitudes towards the platforms and their use. On one extreme, some migrants seemed to conduct almost all of their daily economic life through these technologies, ranging from purchasing snacks in convenience stores to sending remittances back home to their villages in rural China. At the opposite end of the spectrum other migrants largely eschewed these technologies in preference of cash transactions for the majority of uses (Figure 1). Plenty of migrants lay somewhere inbetween, adopting particular features of the platforms as suited their own lives. As is so often the case in anthropology, the ‘data’ reflected not clear observable correlations, but rather a ‘mish-mash’ of differing preferences and attitudes. However, the popularity of Yu’e bao (an online savings account linked to the Alipay payment platform) stood out amongst our interactions. Almost all of the migrants we encountered used this function, often choosing to keep most of their cash savings stored in this way, instead of using traditional cash deposit accounts with (typically State-owned) banks.

Yu’e bao was attractive for a couple of practical reasons. First, money could be instantaneously transferred out of Yu’e bao and into Alipay for spending, transfer or other purposes. Second, as Alipay was owned by a private company, it could reward savers with interest at a slightly higher rate than competing banks. Although participants were often aware of these benefits, it was another issue – the visible way interest was paid into their account – that seemed to most often appear in migrants’ discussions of these services, as evidenced by the exchange between two male migrants below:

“Then there’s Yu’e bao… you put your money in there and you get a little bit of interest everyday …”

“…Because for some people, they don’t necessarily have a lot of money, and they don’t necessarily want to deposit it. Let’s say you put it in, sometimes you’ll earn 0.1RMB, 1RMB, but it’s somewhat small. Seeing your balance growing a little, it’s still [ok]… although the money you earn will never be the same as the devaluation in currency.”

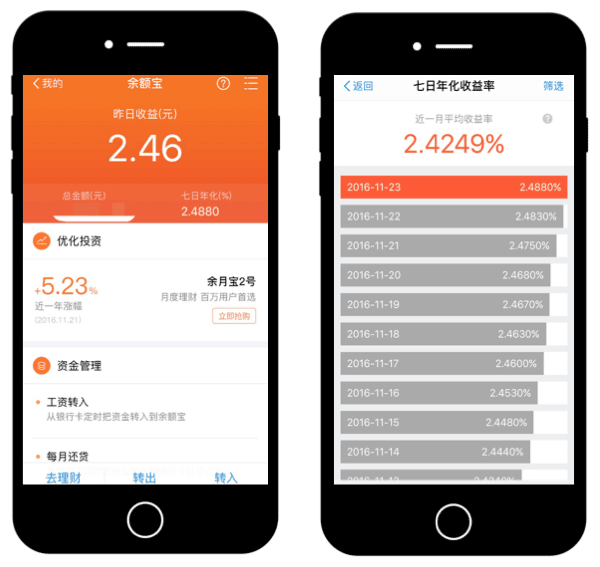

Alipay paid interest into Yu’e bao users’ accounts on a daily basis (instead of monthly or annually, as was the case with banks), while also making both the balance and the daily earnings instantly viewable (Figure 2). It was this increased visibility of users’ savings – rather than the higher interest rates, or added convenience – that particularly appealed to participants. Why were migrant workers particularly eager to have their savings made visible in this way, and what can this tell us about how digital money fits in to the lives of this marginal population?

Part of the answer to this question comes from appreciating the broader context of the financial precarity faced by migrant workers, made manifest in acute anxiety around being cheated out of money. The growth of digital money platforms was perceived to have opened up new avenues through which deception could take place. These risks were also made visible around the communities where migrants lived. Crudely plastered onto the wall of alleyways were adverts for jiedaibao, an online peer-to-peer lending service. “They say it’s a scam,” one migrant worker claimed to me. The State also sought to protect its citizens from other similar risks: every evening a public information video produced by the local police force was displayed on the giant LED video screens in the nearby public square and cinema lobby, both of which were regularly frequented by migrant workers finishing their factory shifts. The video, played at regular intervals, featured a young police officer warning the public to avoid being cheated by taking care not give out their personal details online, and to avoid sending funds to strangers online over social media platforms (Figure 3).

Running parallel to these concerns about online money platforms, many migrant workers also felt a desire to alter their lives so that they would not need to rely on factory work for their income indefinitely. The stability offered by work on the production line came with little room for future progression. Malls and other places located closeby to factories advertised private training courses to learn new skills such as 3D design, hairdressing and beauty treatments, although such courses were expensive, and rarely lead to the kinds of new careers those selling such tuition promised. Migrants also expressed interest in starting business, but were similarly worried about losing income this way.

Understanding this broader context helps us to understand the appeal of Yu’e bao, making migrants’ money – both total savings and also daily growth – more visible to themselves. This appealed to migrant factory workers desire to transform their lives by leaving factory work (with money being deemed necessary for affecting such a change), while ameliorating their fear of losing money through falling victim to cheats or scams. While Yu’e bao’s paltry interest rates may never actually provide migrants with the kind of growth needed for them to realise their ambitions, the platform is nevertheless viewed as a seemingly ‘safe’ place to deposit what limited savings they have, where they can see their money is ‘growing a little everyday’ while also remaining tangible and accessible through worker’s smartphones and mobile apps.

The example of migrant workers in Shenzhen has a broader significance for economic anthropology, confirming Maurer’s assertion that digital forms of money should not be assumed to represent the ‘next stage’ in the evolution of money, or that they are destined to create financial inclusion. Rather, migrant workers in Shenzhen see Yu’e bao as the best option amongst a limited range of places for storing their money because it addresses specific concerns about managing risk while also appearing in accordance with a desire to alter their lives through financial accumulation, even if the rewards of saving this way mean that such aspirations may never truly materialize.

Tom McDonald is an Assistant Professor at the Department of Sociology, University of Hong Kong. His first solely-authored monograph, Social Media in Rural China: Social Networks and Moral Frameworks (UCL Press), was published in 2016. He also co-authored the volume How the World Changed Social Media (UCL Press). McDonald is currently investigating digital money in China.